In the fast-paced world of finance, where every millisecond counts, trading simulators have emerged as invaluable tools for both novice and seasoned traders. These sophisticated platforms don’t merely replicate market conditions; they create immersive environments that mimic the unpredictable ebb and flow of the actual stock market.

But how do they achieve such remarkable realism? From advanced algorithms that analyze vast datasets in real time to intricate models that reflect human behavior, the technology behind trading simulators is a complex tapestry woven from cutting-edge innovations. With virtual portfolios and simulated currency fluctuations, traders can experience the thrill of making split-second decisions without the risk of real-world consequences.

Dive deep into the world of trading simulators, where technology and strategy converge to forge the next generation of traders—ready to navigate the tumultuous waves of financial markets.

Core Technologies Used in Trading Simulators

Core technologies underpinning trading simulators encompass a diverse array of sophisticated tools and methodologies designed to recreate the nuances of real-world financial markets. At the heart of these systems lies advanced algorithmic engines that process vast datasets in real-time, enabling realistic price formations and volatility mimicking the fluctuations observed during actual trading hours.

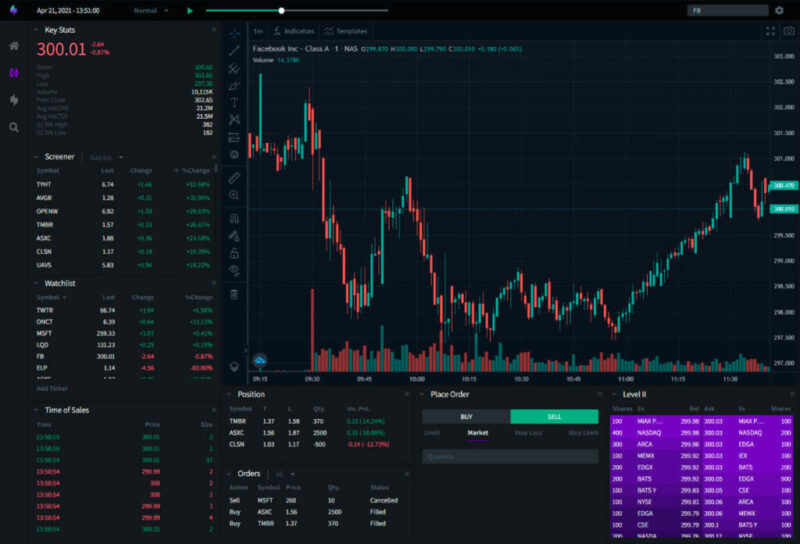

Coupled with high-fidelity graphical interfaces, these simulators present an engaging experience, allowing users to visualize complex trading scenarios as they unfold. Included among these features is the replay chart free tool, which enables users to revisit past market conditions for analysis and strategy refinement. Machine learning algorithms enhance this realism further, continuously refining predictive models based on historical trends and user behaviors, while APIs facilitate seamless integration with various financial data providers.

All these technologies converge, resulting in an immersive environment where traders, both novices and seasoned, can hone their skills and strategies without the inherent risks of real-world trading.

Graphics and User Interface Design

In the realm of trading simulators, graphics and user interface design serve as the pivotal elements that breathe life into virtual market environments. An aesthetically pleasing yet functional interface captivates users from the moment they enter, guiding them through the complexities of trading with intuitive controls and vibrant visuals.

Striking a balance between realism and usability, designers incorporate intricate charts and dynamic data feeds that mimic actual market conditions, while also ensuring that newcomers can easily grasp the essentials. The fluid animations of stock movements and the thoughtful layout of buttons not only render the experience visually engaging but also bolster the immersion, as traders can tweak strategies and watch their decisions unfold in real time.

Ultimately, the synergy between compelling graphics and seamless user interfaces transforms a simple learning tool into a robust platform for both novice and seasoned investors alike, empowering them to navigate the often tumultuous waters of finance with confidence.

Future Trends in Trading Simulator Technology

As we look to the future of trading simulator technology, one can expect a fascinating convergence of advancements that will redefine how users interact with market environments. Imagine simulators powered by artificial intelligence that not only adapt to individual trading styles but also simulate real-world unpredictability, creating adaptive scenarios based on current market news and trends.

This evolution goes beyond simple rule-based simulations—users might soon find themselves immersed in fully realized virtual trading floors, enhanced by virtual reality and augmented reality technologies, where the sensory experience amplifies engagement and learning. Furthermore, integrating social trading features could foster collaborative competition among users, allowing traders to not only practice their skills but also to learn from the strategies employed by others in real-time.

Ultimately, as technology continues to advance, the lines between virtual trading and actual market experiences will blur, paving the way for a new era in trader preparation and education.

Conclusion

In conclusion, the technology behind trading simulators plays a crucial role in shaping realistic market environments that enhance the learning experience for both novice and experienced traders. Through the use of advanced algorithms, real-time data integration, and immersive interfaces, these simulators provide a safe and engaging platform for users to develop their strategies and hone their skills.

Tools like the replay chart free tool empower traders to analyze past market conditions, refine their techniques, and build confidence before venturing into live trading. As the financial landscape continues to evolve, the importance of sophisticated trading simulators cannot be overstated, as they pave the way for informed decision-making and increased market acumen, ultimately leading to more successful trading outcomes.